Market Based Affordability – Our Prescription for the Pain

Understanding Affordability in Today's Vehicle Market

The average person often struggles to understand what they can truly afford, especially in today’s dynamic economic environment. While many maintain budgets and have a general sense of their monthly income, this doesn’t always translate into clarity around vehicle affordability. For instance, asking, “What vehicle can I afford for $500 per month?” is far more complex than it appears. Simply browsing vehicles based on price or selection on shopping websites won't provide the full picture. And the answer needs to be more than, “Schedule an appointment, and we’ll help you.”

The Complexity of Market Based Affordability

Affordability in the automotive market isn’t linear. In fact, it resembles a dynamic scatterplot, with over 70 variables influencing each car deal. Every consumer, vehicle, and permutation of these factors can create massive swings in affordability.

Consumers often believe that dealerships are the root cause of affordability challenges due to pricing. However, in today’s market, other factors like OEM (Original Equipment Manufacturer) incentives and lender rates have a far greater impact on monthly payments.

For example, a $500 discount on a vehicle with a 7.5% APR and no cash incentives might not result in a payment that feels affordable. Surprisingly, lower-priced vehicles can sometimes lead to higher payments than higher-priced ones, depending on the deal structure. And this doesn’t even account for additional consumer variables such as loan terms, credit scores, trade-ins, down payments, or taxes.

The Pandemic’s Lingering Impact: Negative Equity

One of the market’s most significant challenges is the growing issue of negative equity, driven by pandemic-era demand and low supply. According to Edmunds, the average negative equity has increased year-over-year to $6,458. As a result, many consumers feel trapped, unable to trade in their current vehicle without incurring a financial loss.

Unfortunately, dealerships operating on slim margins - typically around 7% - cannot absorb these costs. Without support from OEMs and lenders, many consumers remain stuck. However, if consumers were better educated on their options, they might find ways to offset this negative equity and trade up.

Misunderstanding Incentives and Rates

Consumers often misunderstand their financing options. While OEMs advertise attractive Tier 1 subvented rates (e.g., 0% APR for 36 months), these promotions are often based on unrealistic scenarios. If a consumer is $6,500 underwater on their current vehicle and shopping solely by price, they may miss opportunities to trade in—or trade up—because they lack the necessary tools and insights.

Some lenders are stretching loan-to-value (LTV) ratios to absorb this inequity, and incentives are trending positively. For example:

Incentives as a Percentage of Average Transaction Price: According to Cox Automotive, this metric has grown from 6% to 7.7% in 2024.

Cash Offers: Carmatic data shows that while the average lease incentive is $2,114 and loan incentive is $785, some models offer consumer cash incentives of $5,000 to $15,000!

Additionally, interest rates are becoming more competitive. While Federal Reserve rates hover around 4.58%, some vehicles have lower APRs and money factors. Carmatic data shows that the average blended APR for leases and loans has dropped from 4.82% to 4.47% in just 15 days. These trends highlight progress toward greater affordability, even in a high-priced market.

A Changing Landscape

Although vehicle prices remain high - averaging over $48,600 - the market is adapting. Incentives are making a difference. In October, for example, eight mainstream automakers offered average incentive packages exceeding 10% of the average transaction price (source: Cox Automotive Car Buyer Journey Study) This reflects a shift in affordability driven by factors beyond just price.

The Consumer’s Affordability Challenge

Understanding affordability isn’t just about knowing how much you can spend—it’s about knowing which vehicles fit your budget. For most consumers, this process feels like rocket science. Despite spending over 14 hours on their shopping journey (source: Cox Automotive Car Buyer Journey Study), they lack the tools to evaluate their real affordability profile. Dealers can analyze affordability quickly, but consumers are left in the dark.

The Future of Affordability Insights

Although some software providers are introducing insights and analytics at a rapid pace, no solution currently delivers a comprehensive view of affordability - an issue that continues to be a major pain point in automotive today. A truly groundbreaking approach would:

Provide a detailed view of all available vehicle options.

Compare affordability across makes, models, terms, incentives, and rates.

Offer insights for individual rooftops, groups, or the entire market.

This is where Carmatic comes in. By eliminating the need to start with a specific VIN, Carmatic empowers consumers and dealers with a clear understanding of Market-Based Affordability. This enhances the omni-channel experience and enables smarter vehicle choices.

Be the Hero Your Customers Need

Help your customers understand their real affordability profile. Show them how they can trade up to a higher-class vehicle for similar - or even less - money, while maximizing profitability for the selling dealer. With Carmatic, you can offer a transformative experience that simplifies vehicle shopping and unpacks affordability for consumers, profitability for dealers and demonstrated ROI for the software vendors that support them.

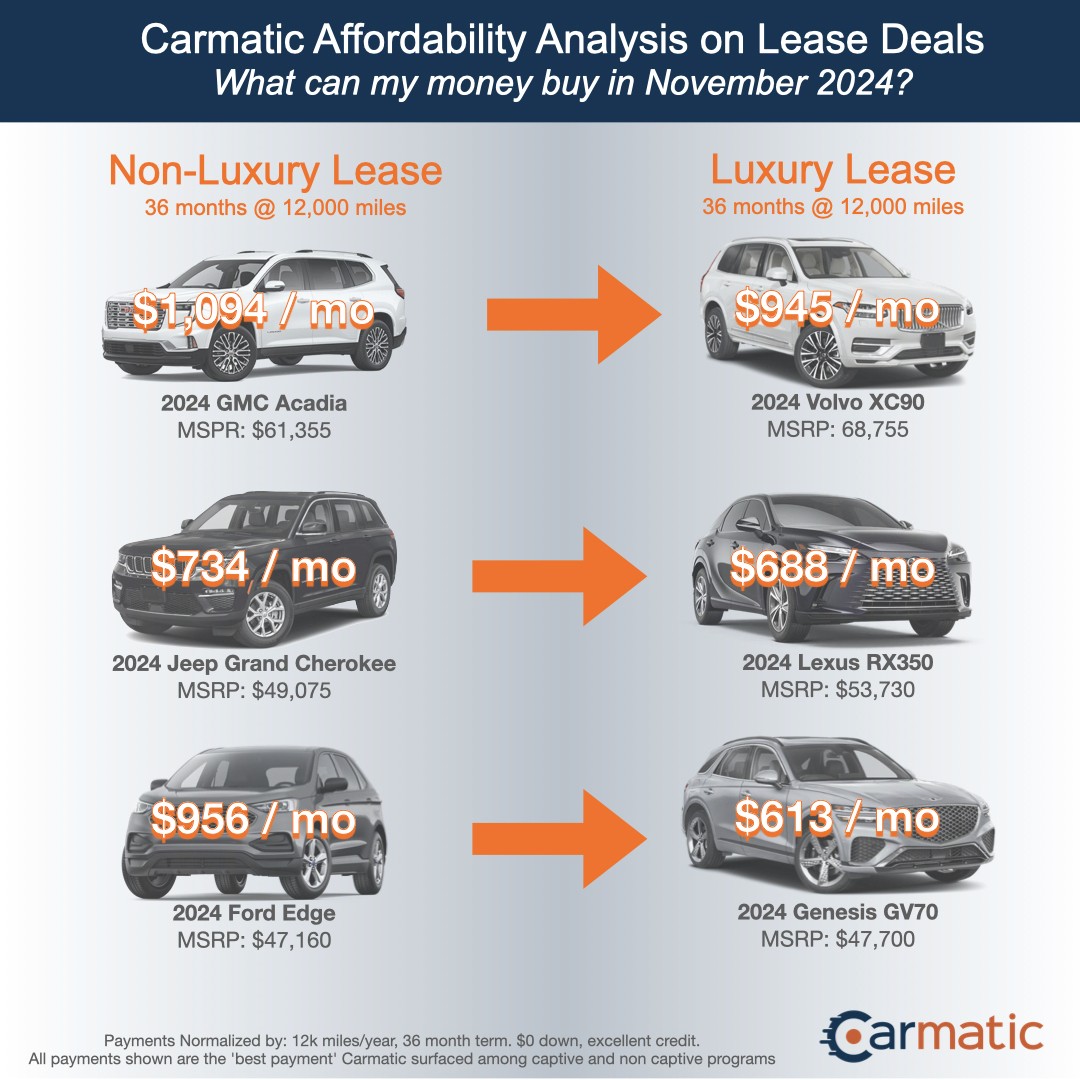

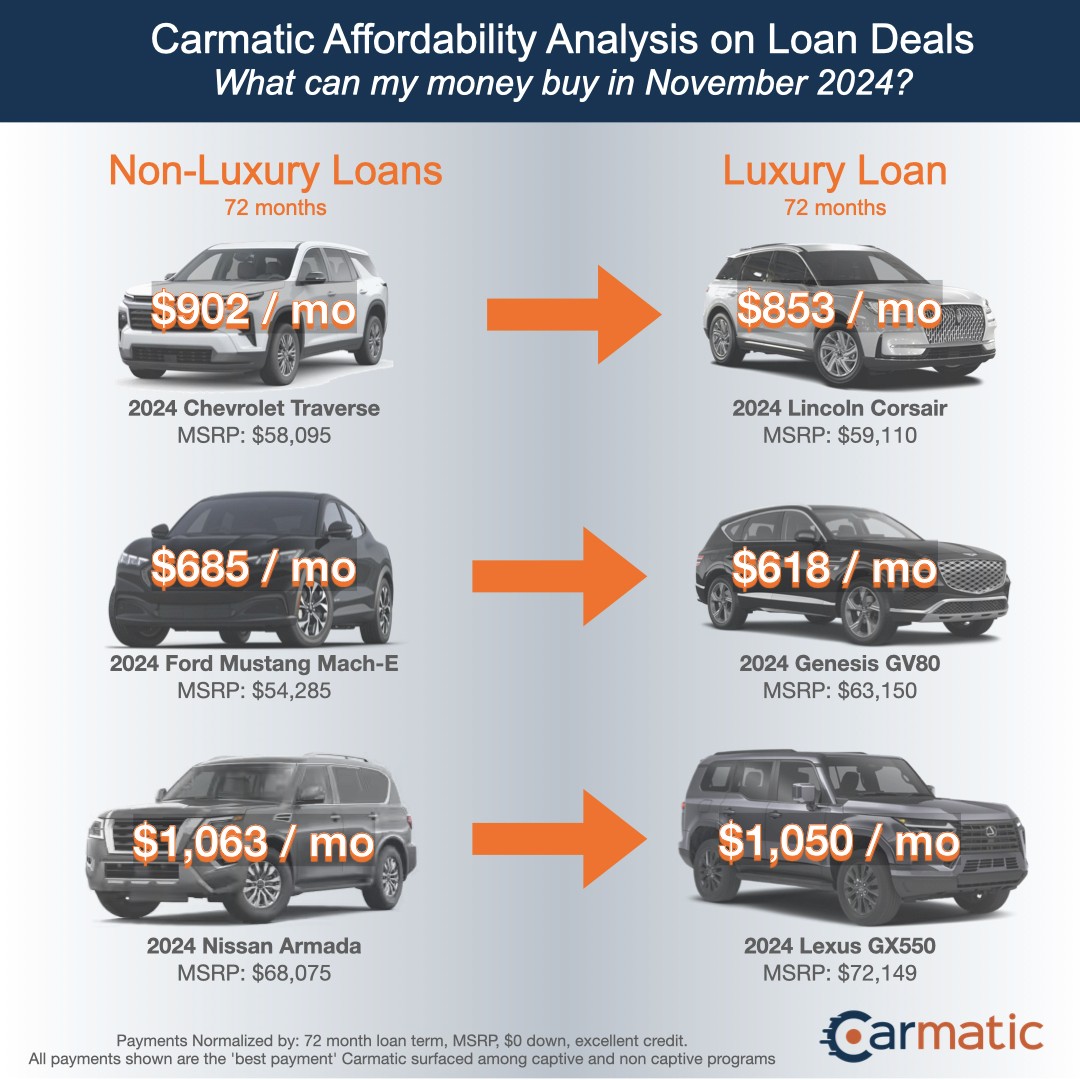

Just take a look at a few of the deals we uncovered over the last 2 weeks! Who would have thought a consumer looking at leasing a GMC Acadia could actually save $150/month and trade up to a Volvo XC90 luxury SUV? Or the shopper who was ready to lease a Jeep Grand Cherokee could get into a Lexus RX350 for $50 less?! And anyone who is ready to purchase a new Chevy Traverse for $902/month…well, you could save $50/month and drive off in a new Lincoln Corsair.

If you’re a software vendor or dealer faced with solving these affordability challenges, we’ve got you covered.

Reach out or find out more at: https://www.carmatic.com/blog/market-based-affordability.